florida estate tax rates 2021

The current federal tax exemptions are at 117 million in 2021. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

9 States With No Income Tax Bankrate

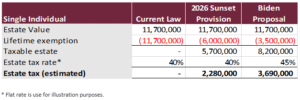

Federal Estate Tax Rates for 2022.

. 69 rows Floridas average real property tax rate is 098 which is slightly lower than the US. Floridas general state sales tax rate is 6 with the following exceptions. The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022.

No Tax Data Broward County Florida Property Tax Go To Different County 266400 Avg. The median property tax in Lee County Florida is 2197 per year for a home worth the median value of 210600. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in.

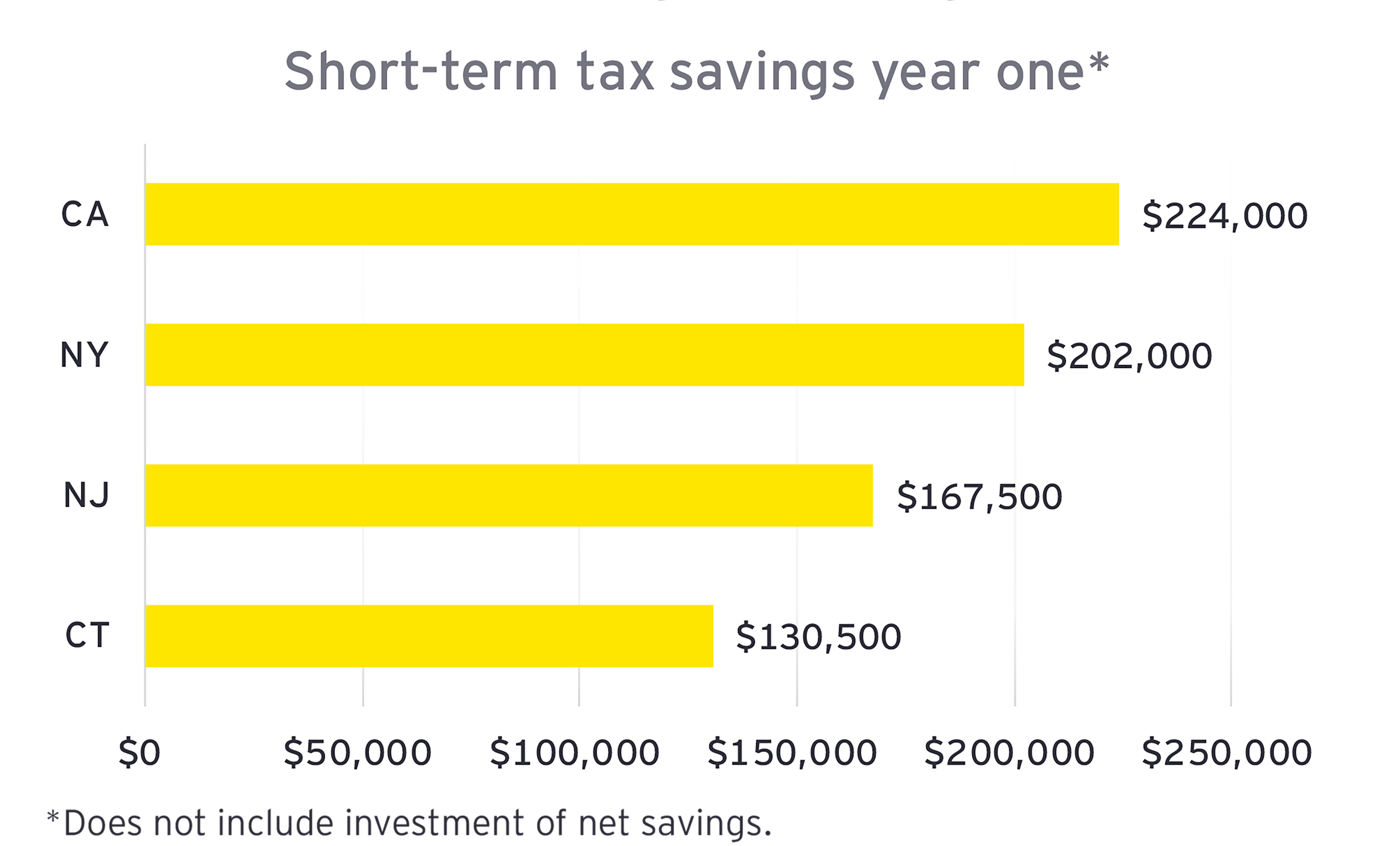

The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. Florida estate planning lawyers help people develop a family or business-friendly strategy to maximize tax savings tax cuts. Florida Estate Tax Exemption 2021.

So even if you qualify for the federal estate tax exemption The top estate tax rate is 12 percent and is capped at 15 million exemption. Counties in Florida collect an average of 097 of a propertys assesed fair. The federal estate tax however.

Florida has a sales tax rate of 6 percent. Tax Valuation and Income Limitation Rates. The decedents assets subject to tax are their taxable estate or the gross estate The federal estate tax rate starts at 40.

According to section 193155 FS property appraisers must assess. Before the official 2022 Florida income tax rates are released provisional 2022 tax rates are based on Floridas 2021 income tax brackets. The 2022 state personal income tax brackets are.

The taxable estate includes assets owned. In addition it can be difficult to calculate the amount of taxes owed after a person dies. Property taxes in Florida are implemented in millage rates.

Lee County collects on average 104 of a propertys assessed fair market. To make things simple if your estate is worth 1206 million or less you dont need to worry about the federal estate tax. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Florida Property Tax Rates. Floating Rate of Interest Remains at 7 Percent for the Period January 1 2022 Through June 30 2022. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

108 of home value Yearly median tax in Broward County The median property tax in Broward. The documents below provide Florida property tax statistical information. Hillsborough County collects on average 109 of a propertys.

The Florida estate tax is different from other states. There is also an average of 105 percent local tax added onto transactions giving the state its 705 percent state and local sales tax. Further reduction in the tax.

The average Florida homeowner pays 1752 each year in real property.

Estate Planning Tips Married Floridians Need When They Near The Proposed Tax Limits Elder Law Attorney St Augustine J Akin Law

State Death Tax Hikes Loom Where Not To Die In 2021

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

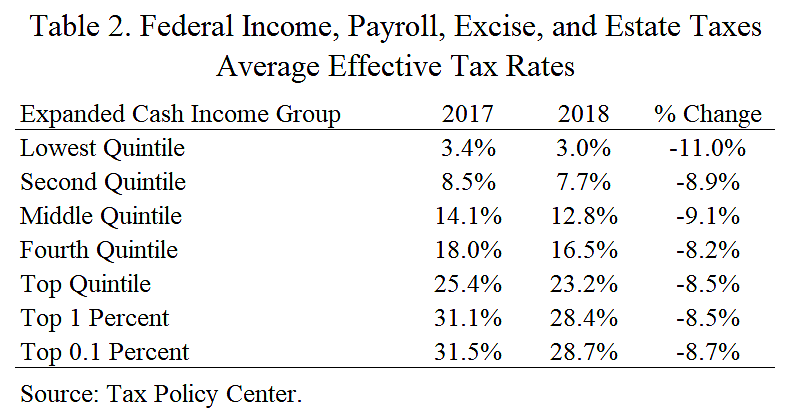

Tax Rates By Income Level Cato At Liberty Blog

Florida Dept Of Revenue Property Tax Data Portal

Property Taxes By County Interactive Map Tax Foundation

Florida Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Federal Estate Tax Sunshine Financial Solutions Insurance Retirement College Funding And Business Solutions

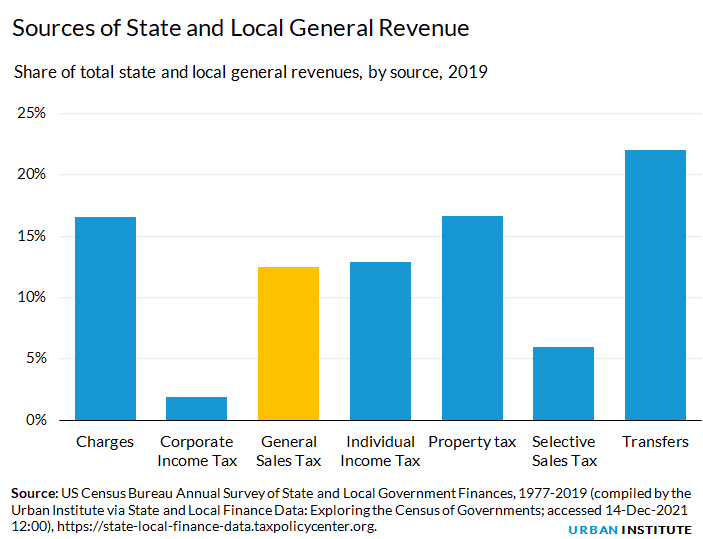

General Sales Taxes And Gross Receipts Taxes Urban Institute

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Tax And Estate Law Changes Financial Harvest Wealth Advisors

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Estate Tax Planning And Using A B Trusts For High Net Worth Estates Estate Planning Attorney Gibbs Law Fort Myers Fl

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate