how to calculate a stock's price

Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts. 56 as per the last trade.

How To Find The Current Stock Price Youtube

Intrinsic value Sum of a.

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

. In this case the closing price will be calculated by dividing the total product 1872 by. Enter the number of shares purchased. Multiply the number of shares in each transaction by its purchase price.

Input the expected dividend yield as 1. The intrinsic value p of the stock is calculated as. When Benjamin Graham Formula formula is used to Heromoto the Graham number is as follows.

Of share you want to buy NSB. To use the MarketBeat Stock Split Calculator youll need just three pieces of information. Every publicly-traded company when its shares are issued is given a price an.

The current share price. The formula for this calculation is straightforward. When calculating the PE of an individual company you can divide the companys market price by its EPS.

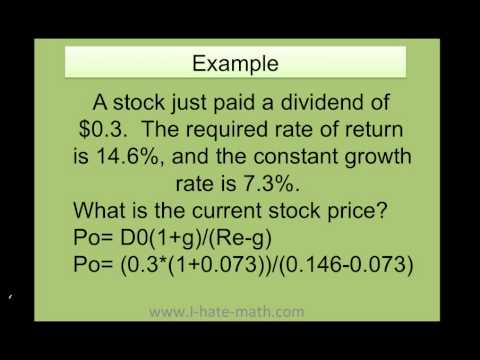

2 005 - 003 100. The number of stocks in turnover is 132637878. The algorithm behind this stock price calculator applies the formulas explained here.

Type the risk-free interest rate in percentage ie 3. The number of shares owned before the split. So based on the above formula the ROE for Texas Pacific Land is.

As a result we get the real stock price 1471 USD. According to the Gordon Growth Model the shares are correctly valued at their intrinsic level. The Black Scholes option.

Calculate Your Total Cost. Ad Trade on One of Three Powerful Platforms Built by Traders For Traders. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding.

Graham Number Square root of 1853 x 15 14839 x 184079. A trader watching their monitors might notice how the price of stock ABC moves from 100 to 105. Heres an example using the SP 500 Index.

The term stock price refers to the current price that a share of stock is trading for on the market. The closing price of stock A in the above example is not Rs. Just follow the 5 easy steps below.

The simplest way of calculating the intrinsic value of a stock is to use an asset-based valuation. The return refers to. To calculate the PE ratio of the Nifty 50 index you need to take the.

2618 990000 - 666980000 132637878 1471 USD. Ad Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages. These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience.

However if 200000 shares have so far in that session been traded at. However stock prices are usually driven by a companys financials over the long term which in. In other words we can stay that the Stock Price is calculated as.

Announces a 21 stock. In this example multiply 100 by 10 to get 1000 multiply 200 by 7 to get. State the expected volatility of the stock ie 20.

The PE ratio is calculated by dividing the price of the stock by the total of its 12-months trailing earnings. The Stock Calculator is very simple to use. Ad MarketSmith helps you invest in the right stocks at the right time-Take a trial.

As Easy as 1-2- 3. In this case the adjusted closing price calculation will be 20 1 21. Companies that are growing rapidly will have higher PE ratios.

This will give you a price of 667 rounded to the nearest penny. Lets say the index was at 4500 when you bought shares of a related index fund and at 4650 when you sold your shares. News NASDAQNWSA has had a rough month with its share price down 94.

Finding the growth factor A 1 SGR001. 59 US380m US645m Based on the trailing twelve months to June 2022. Enter the purchase price per share the selling price per share.

Excel Formula Get Stock Price Latest Close Exceljet

Price Volatility Definition Calculation Video Lesson Transcript Study Com

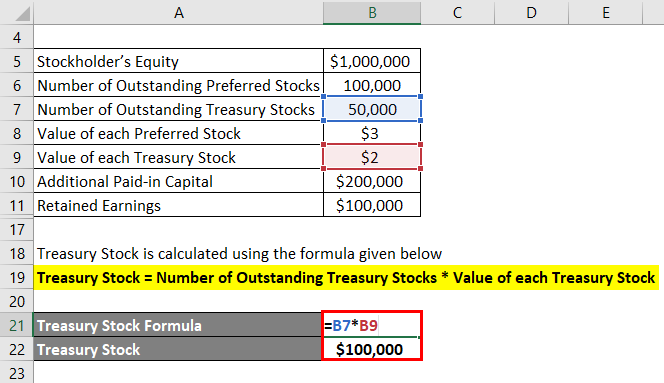

Common Stock Formula Calculator Examples With Excel Template

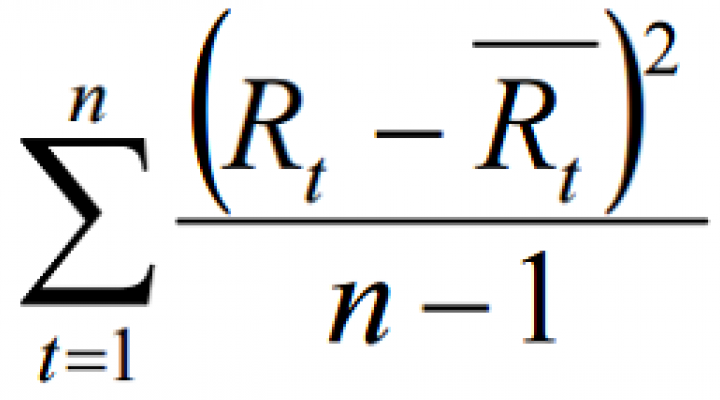

How To Calculate The Historical Variance Of Stock Returns Nasdaq

Is There A Mathematical Formula To Calculate A Stock Price Quora

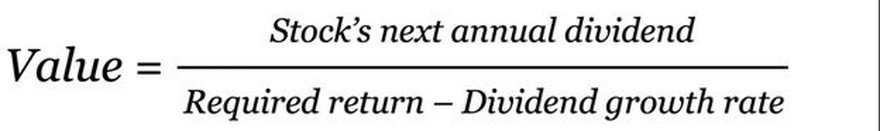

How To Calculate Future Expected Stock Price The Motley Fool

Common Stock Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Weighted Average Price Per Share Fox Business

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

How To Value A Company Money Management Advice Business Investment Money Strategy

Quarterly Average Balance Meaning Calculation Average Balance Meant To Be

Cost Of Equity Definition And How To Calculate

This Free Online Stock Investment Calculator Will Calculate The Expected Rate Of Return Given A Stock S Current Dividend Investing Online Stock Investing Money

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)